lake county sales tax ohio

A full list of these can be found below. OH Rates Calculator Table.

Sheffield Lake Ohio Oh 44054 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The latest sales tax rates for cities in Ohio OH state.

. What is the sales tax rate in Lake County. The minimum combined 2022 sales tax rate for Lake County Ohio is. Groceries are exempt from the Lake County and Ohio state sales taxes.

THE LAKE COUNTY TREASURERS OFFICE IS OPEN TO THE GENERAL PUBLIC. Search by Owner name. Type the parcel ID into the search box above.

Every effort is made to see that you receive your tax bills. Auditor land bankstate of ohio. Rates include state county and city taxes.

2020 rates included for use while preparing your income tax deduction. The sales tax rate for Lake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Lake County Ohio Sales Tax Comparison Calculator for 202223. A county-wide sales tax rate of 15 is applicable to localities in Lake County in addition to the 575 Ohio sales tax.

Skip to Sidebar Nav. 105 Main Street Painesville OH 44077 1-800-899-5253. Home Departments Treasurer Sold Tax Lien Certificates.

Help us make this site better by reporting errors. Or visit our Ohio sales tax calculator to lookup local rates by zip code. Sales tax in Lake County Ohio is currently 7.

However Section 32313 of the Ohio Revised Code provides that the property owner is responsible for. If this rate has been updated locally please contact us and we. Lake 100 050 725 Wood 100 675 Lawrence 150 725 Wyandot 150 725 Note.

Average Sales Tax With Local. The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1. The states sales and use tax rate is currently 575 March 11 2022 The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax.

Lake County Ohio. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County. The Ohio state sales tax rate is currently.

Lake county land reutilization corporation. As for zip codes there are around 10 of them. Generally the minimum bid at an Lake County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

105 Main Street Painesville OH 44077 1-800-899-5253. Lake county ohio treasurer site. 2022 1st Quarter Rate Change.

105 Main Street Painesville OH 44077 1-800-899-5253. Lake county land reutilization corporation. Lake County OH Sales Tax Rate.

Lake County in Ohio has a tax rate of 7 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Lake County totaling 125. 112991 2021 Terms of Use Copyright 2020. If you need access to a database of all Ohio local sales tax rates visit the sales tax data page.

The sales tax rate does not vary based on. For best results leave off the street suffix. Lake County OH currently has 524 tax liens available as of May 7.

Skip to Sidebar Nav. How much is sales tax in Lake County in Ohio. These buyers bid for an interest rate on the taxes owed and the right to collect back that.

Search by parcel number. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. Lake County Ohio.

The most populous location in Lake County Ohio is Mentor. 105 Main Street Painesville OH 44077 1-800-899-5253. The Lake County sales tax rate is.

2020 rates included for use while preparing your income tax deduction. You can find more tax rates and allowances for Lake County and Ohio in the 2022 Ohio Tax Tables. 105 Main Street Painesville OH 44077 1-800-899-5253.

The 2018 United States Supreme Court decision in South Dakota v. Lake County is located in Ohio and contains around 8 cities towns and other locations. Lake county land reutilization.

There are a total of 578 local tax jurisdictions across the state collecting an average local tax of 1505. Type in full name or part of the name into the Owner box. Lake County Ohio.

The average cumulative sales tax rate between all of them is 725. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 075. Use the to find a group of parcels.

Auditor land bankstate of ohio. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Lake County Tax Deeds sale.

Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225. The current total local sales. The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax.

This rate includes any state county city and local sales taxes. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Lake County OH at tax lien auctions or online distressed asset sales. Lake County collects a.

US Bank as CF for Tax Ease Ohio. Columbus Ohio 43216-0530 taxohiogov County. Lake County Ohio Local County Sites.

2022 Ohio Sales Tax By County Ohio has 1424. This is the total of state and county sales tax rates. Skip to Sidebar Nav.

Heres how Lake Countys maximum sales tax rate of 8 compares to other counties around the United States. Population 230149 2019 Parcels. Ashtabula County Cuyahoga County Geauga County.

Home Departments Treasurer Property Tax Due Dates. History of tax lien sales in ohio house bill 371 introduced on april 8 1997 and signed into law on november 26 1997 allowed. Always consult your local government tax offices for the latest official city county and state tax rates.

Use as a wild card to match any string of characters. Lowest sales tax 6 Highest sales tax 8 Ohio Sales Tax. Generally the minimum bid at an lake county tax deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

Ohio Sales Tax Rates By City County 2022

Full Ust 1 Data File Upload Department Of Taxation

Real Estate Tax Rates And Special Assessments Auditor

Spotlight On Ohio Local Taxes Local Taxes Local Tax Compliance

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

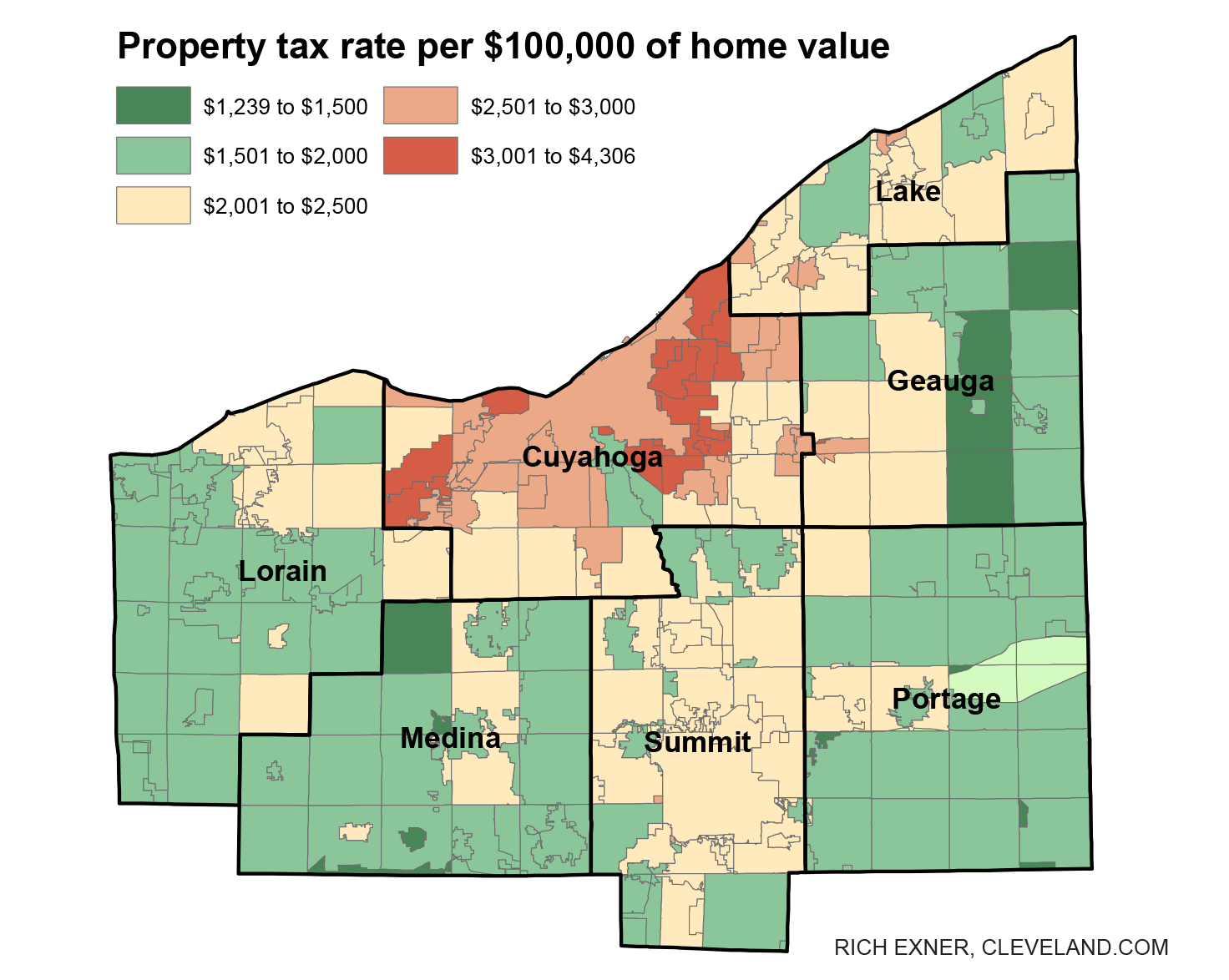

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Ohiomeansjobs Centers Office Of Workforce Development Ohio Department Of Job And Family Services

Taxes In Cincinnati Ohio Vs Northern Kentucky Is It Better To Live In Oh Or Ky Team Sztanyo Keller Williams Advisors Realty

Ohio Sales Tax Guide For Businesses

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com